Thanks to a new credit card, you soon will be able to collect rewards for indulging in your Starbucks caffeine fix. But given the interest rates and fees on the new Starbucks credit card, you could be left trying to fix your beaten-up credit. (more…)

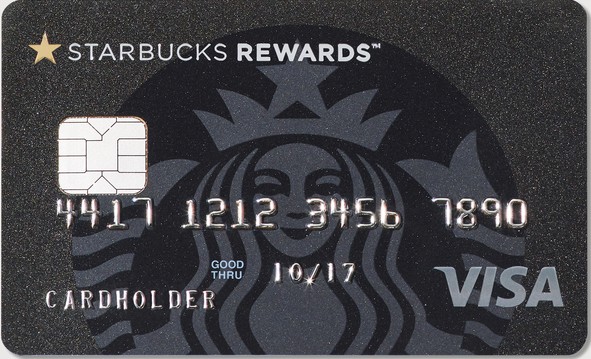

The coffee shop chain has teamed up with credit card issuer Chase for the Starbucks Rewards Visa card, which will be linked to the Starbucks Rewards program.

How the new Starbucks credit card works

Both inside and outside Starbucks stores, cardholders can earn Starbucks Rewards stars wherever Visa cards are accepted. The stars then can be redeemed for Starbucks food and beverages. All cardholders will be enrolled in the Starbuck Rewards program.

Cardholders will receive a credit card within seven to 10 days of their application being approved. Meanwhile, a digital card will be immediately loaded onto the Starbucks mobile app so customers can start earning stars right away.

The benefits

Here’s the rundown of the card’s benefits:

- 2,500 stars after spending $500 on purchases in the first three months after the account is opened. That’s equivalent to 20 food or beverage items.

- 250 stars when using a Starbucks Rewards Visa to load a registered Starbucks Rewards card within the Starbucks mobile app for the first time.

- One star for every $4 spent outside Starbucks stores.

- Up to three stars for every $1 spent in Starbucks stores.

- One star for every $1 digitally loaded onto a registered Starbucks Rewards card in the Starbucks mobile app, using the credit card, in addition to the two stars per $1 earned when paying with a registered Starbucks Rewards card as a member of the rewards program.

- Instant gold status in the rewards program.

- Eight barista picks, consisting of “curated” food or beverage items that automatically are deposited into a rewards account.

The drawbacks

Now, here are some of the drawbacks:

- A purchase APR (interest rate) ranging from 17.24% to 24.24%. As of February 2018, the national average for a purchase APR on a credit card was a little over 16%.

- A balance-transfer APR of 17.24% to 24.24%.

- A cash-advance APR of 24.24%.

- An annual fee of $49.

- A balance-transfer fee of $5 or 5%, whichever is greater.

- A cash-advance fee of $10 or 5%, whichever is greater.

- A foreign-transaction fee of 3%.

- A late-payment fee of up to $15 if the balance is less than $100, up to $27 if the balance is $100 to less than $250 and up to $37 if the balance is $250 or more.

Is the the new Starbucks credit card worth it?

Here’s my take on the card: Unless you’re a regular Starbucks customer, there’s no use in getting this piece of plastic. And even if you’re a regular Starbucks customer, the APRs and fees on this card should leave a bad taste in your mouth — although you can avoid them by paying off the balance in full every month.

If you’re in the market for a rewards card, you might want to instead check out something like the Citi Double Cash card or the Amex Everyday Preferred.

By the way, if this new Starbucks credit card isn’t your cup of tea, Starbucks is launching a prepaid rewards card later this year. I hope the fees for the prepaid card won’t steam me as much as the ones for the credit card do.