When it comes to credit cards, separating fact from fiction can be tough. A friend might tell you something about credit cards that turns out to be false, or you might find credit card information online that’s just flat-out wrong. (more…)

We want to clear up some common credit card myths so that you’re not misinformed and making mistakes based on incorrect information.

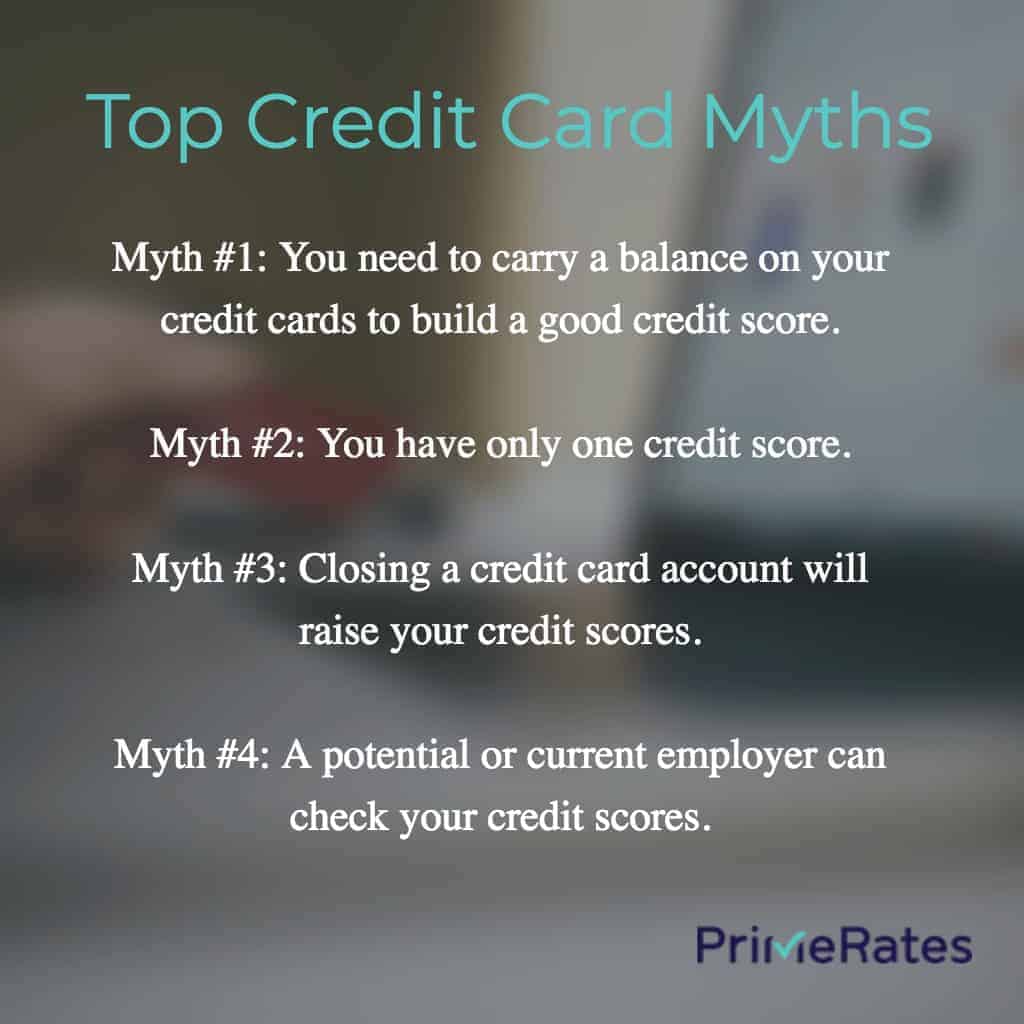

Here’s the 411 on four common credit card myths:

Myth #1: You need to carry a balance on your credit cards to build a good credit score.

Fact: You do not need to carry a balance on your credit cards to build a good credit score.

“This myth is still floating around out there,” credit card expert Beverly Harzog says. “To boost your score, pay your bill in full and on time. If you carry a balance, you’ll pay interest on your purchases. That’s money out of your pocket, and you don’t get any credit benefit from that at all.”

According to Experian, one of the major credit-reporting bureaus, the most important factor in determining your credit score is your payment history — whether you pay your bills on time.

The second most important factor, Experian says, is something known as your credit utilization rate. That takes into account how much credit you have available and how much credit you’re using. The lower your utilization rate is, the better it is for your credit score.

Myth #2: You have only one credit score.

Fact: You have more than one credit score.

From time to time, you might ask yourself, “What’s my credit score?”

However, there’s no single answer to that question because you have more than one credit score. And the notion that we only have one score is one of the more common credit card myths out there. Actually, most of us probably have dozens of credit scores.

How is that possible?

Two companies, FICO and VantageScore, generate the bulk of credit scores. Right there, that means you’ve got two credit scores. Then, each of the three credit-reporting bureaus — Equifax, Experian and TransUnion — generates a FICO score and a VantageScore for each person who has a credit report. That adds up to six separate credit scores.

On top of that, credit card issuers and other lenders have their own credit-scoring models, aside from FICO’s and VantageScore’s models. As a result, there are many more credit scores that are attached to your name.

Myth #3: Closing a credit card account will raise your credit scores.

Fact: Closing a credit card account might lower your credit scores.

It might seem like closing a credit card account would be a smart way to improve your credit, but it actually can have the opposite effect.

Credit card issuer Discover recommends not shutting down a credit card account unless you have to. Why?

Permanently removing a credit card from your wallet reduces the amount of credit you have available. Since one of the factors for figuring out your credit scores is how much credit you’ve got, you could damage your scores by closing an account.

Discover says that in some cases, it might be wise to close a credit card account. For instance, if you find that you’re putting too many charges on a credit card, you might want to get rid of that account so you can prevent overspending. Or, Discover says, you might want to shut down an account if the interest rate or fees have gone up a lot.

If you feel the need to close an account, try not to shut down any of the oldest ones, Discover suggests. Length of credit history is one of the factors used in establishing your credit scores, so if an older account goes away, the length of your credit history decreases.

Myth #4: A potential or current employer can check your credit scores.

Fact: A potential or current employer cannot check your credit scores.

In most states, a potential or current employer can check your credit reports as part of the screening process for hiring or promotion. But that’s not the same as checking your credit scores.

Credit reports and credit scores are separate; your credit reports don’t list your credit scores. Typically, your credit scores are viewed only by you and by lenders that are considering whether to extend credit to you.

According to Experian, the credit reports that an employer can see aren’t the same as the credit reports that you can see. A credit report prepared for an employer will leave out your account numbers, your birthdate and any references to a spouse.

“Traditionally, the biggest users of credit reports for employment purposes are companies in the defense, chemical, pharmaceutical and financial services industries because of the sensitive positions many of their employees hold,” Experian says. “Increasingly, other industries use the reports to serve as a general indicator of an applicant’s financial honesty and personal integrity.”

By the way, a potential or current employer can’t pull your credit reports without your written permission.

Interested in signing up for a new credit card? Start shopping.